Nature-Based Crop Protection Is Becoming the New Normal

For decades, synthetic pesticides were the backbone of global agriculture. They worked fast, they worked predictably, and they were affordable. But the world has changed. Resistance issues, new regulations, and pressure for cleaner food have pushed agriculture into a new era.

In 2025, nature-based crop protection isn’t a niche movement anymore — it’s going mainstream. Growers, retailers, and regulators are aligning behind solutions that work with natural biology rather than relying solely on chemicals.

Below are the three major forces driving this shift — each one powerful enough on its own, but together they’re transforming agriculture faster than anyone expected.

1. Global Rules Are Changing — Fast

One of the biggest drivers behind the shift to biologicals is simple: the world is running out of patience for older, high-risk chemistries.

A wave of restrictions

The EU has led the charge:

- Neonicotinoids (imidacloprid, clothianidin, thiamethoxam) were banned for outdoor use in 2018 due to pollinator threats.

- Mancozeb, one of the most widely used fungicides in the world, lost EU approval in 2021 and has since disappeared from EU-compliant programs.

And this is only part of the story. Many countries are quietly raising MRLs (maximum residue limits) and reviewing older pesticide classes. These changes are especially critical for countries that depend on agricultural exports — a single residue violation can block entire shipments.

Why biologicals fit the new rulebook

Biological products — microbials, botanicals, and semiochemicals — naturally:

- Decompose quickly

- Have low residue profiles

- Avoid many pollinator and worker-safety concerns

- Reduce the risk of international shipment rejection

In a world tightening its regulatory belt, biologicals don’t just comply — they future-proof the farm.

2. Consumers Are Paying for Cleaner Food

The second force reshaping crop protection comes from supermarket shelves, not government offices.

The organic & “clean-label” boom

The demand for cleaner food is no longer a trend — it’s a market driver backed by real money.

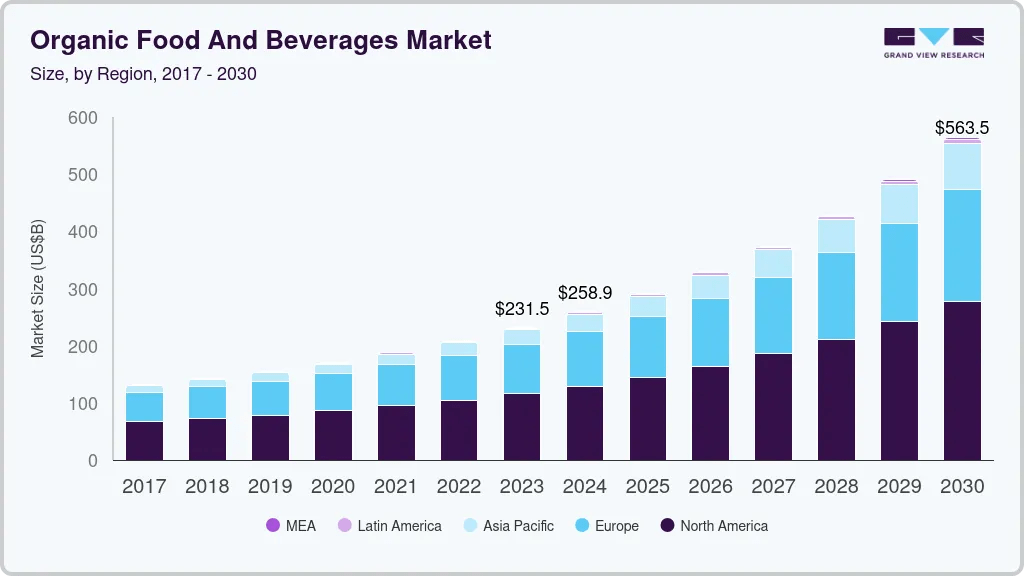

- The global organic food and beverage market reached $231.5 billion in 2023.

- It’s projected to hit $563.5 billion by 2030, growing at 13.6% CAGR.

This isn’t happening because organic apples taste better. It’s happening because:

- People want less chemical residue on their food.

- Pollinator decline is a mainstream concern.

- Younger consumers expect transparency, sustainability, and low-impact farming.

- Retailers are building entire product lines around “residue-conscious” produce.

And retailers pass the pressure downward

Major supermarkets and food brands now tell their growers:

“Reduce residues. Reduce chemical load. Show us your sustainability plan.”

Biologicals give growers a practical way to:

- Maintain crop protection

- Meet retailer residue standards

- Preserve access to high-value markets

Clean food requires cleaner tools — and biologicals are filling that role.

3. Biological Products Finally Perform Like Real Tools

A decade ago, biologicals had a reputation problem. They felt “soft,” inconsistent, or too sensitive to weather.

That reputation no longer matches reality.

A fast-growing market backed by real performance

Different market reports vary slightly in numbers, but all show the same trend:

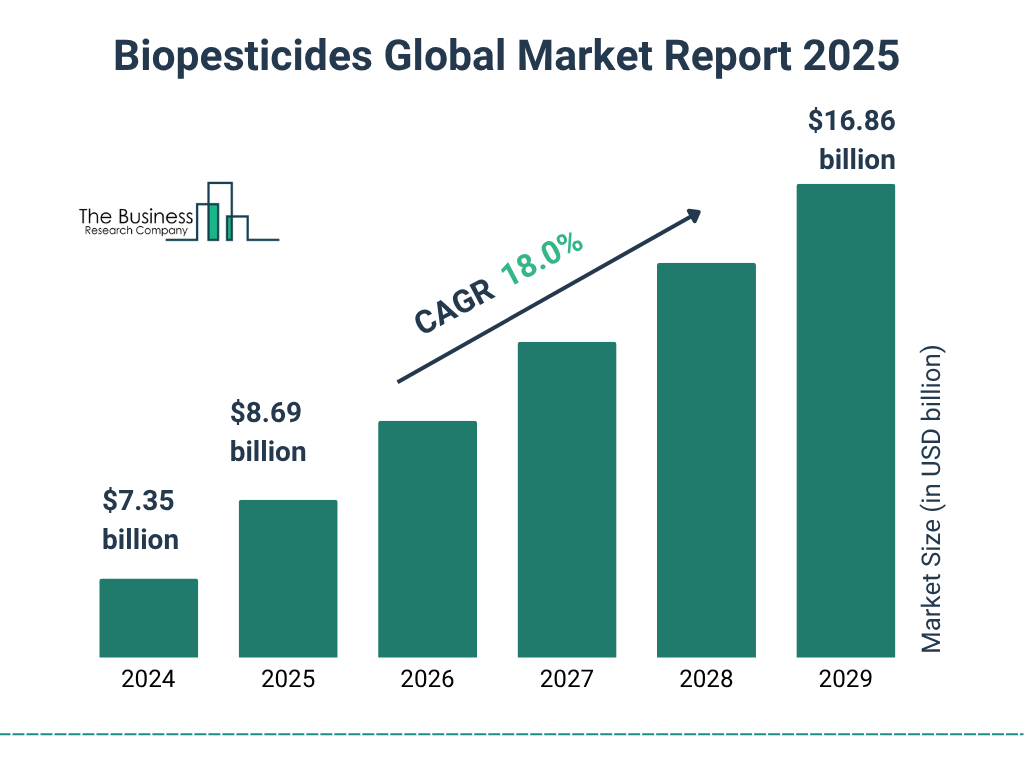

- $7.3 billion in 2024 → over $16.86 billion by early 2029s

- Average growth: ~18% CAGR, far outpacing synthetic chemicals

Why the performance gap has closed

Modern biologicals benefit from major advances in:

- Strain selection (only the most aggressive, consistent strains make the cut)

- Fermentation technology (more stable active compounds)

- Formulation science (encapsulation, stabilizers, UV protectants)

- Field-use knowledge (clear application timing & compatibility guidelines)

The result? Biologicals now provide repeatable, predictable control — something they couldn’t consistently do 10 years ago.

And growers are responding

- In North America, row crops like corn and soy already represent over 80% of biopesticide use.

- In high-value fruits and vegetables, growers switch to biologicals late in the season to avoid residue issues.

- In Brazil, India, and parts of APAC, government-driven “bio-inputs” programs are fueling record adoption.

When large-acre farmers start using biological at scale — not just organic farms — it signals a foundational shift in agriculture.

Where This All Leads: A Hybrid, Smarter Crop-Protection Era

Biologicals are not replacing synthetic chemistry overnight — and they don’t need to. What’s emerging is a hybrid model:

- Chemistry for early-season, high-pressure moments

- Biology for residue-sensitive, resistance-prone, or late-season windows

- Cultural and precision practices wrapping around both

This blended approach is:

- More sustainable

- More resistant to pest evolution

- More acceptable to regulators and retailers

- More aligned with consumer expectations

Biologicals aren’t the alternative anymore — they’re becoming one of the essential pillars of modern crop protection.

And as technology continues to advance, they’re poised to be one of the most important building blocks of the next generation of agriculture.

Leave a comment