1. Southeast Asia’s Growing Interest in Durian

Vietnam: A major shift is underway as many coffee farmers are converting their farms into durian orchards, reflecting the crop’s rising profitability.

Laos: In 2024, the Laotian government announced its expectations that durian could become a key tool for poverty reduction in rural areas.

Malaysia: In June 2024, Malaysia’s Minister of Agriculture publicly stated, “Durian will be the next economic boom for Malaysia,” highlighting national support for expanding durian cultivation and exports.

Indonesia: The country is rapidly expanding durian plantations with the goal of exporting frozen durians to China as a strategic alternative to Thai and Vietnamese supply.

2. China’s Explosive Demand for Durian

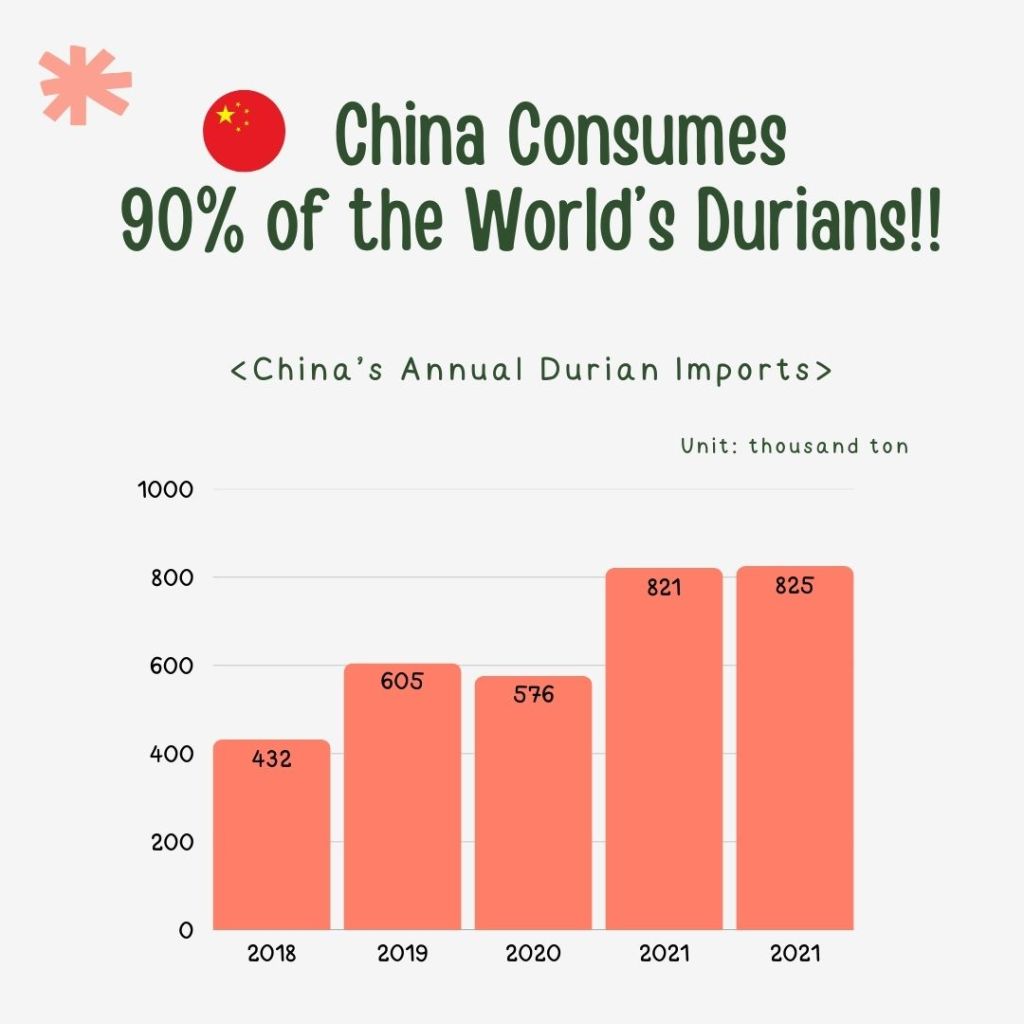

China now consumes over 90% of globally traded durians, making it the largest durian market in the world.

Between 2017 and 2023, China’s annual fresh durian imports increased 12-fold, while the average market price surged more than 15 times. In 2023, China broke records by importing $6.7 billion worth of durians, up from $1.6 billion in 2019 and $4 billion in 2022.

3. The Durian Supply War in Southeast Asia

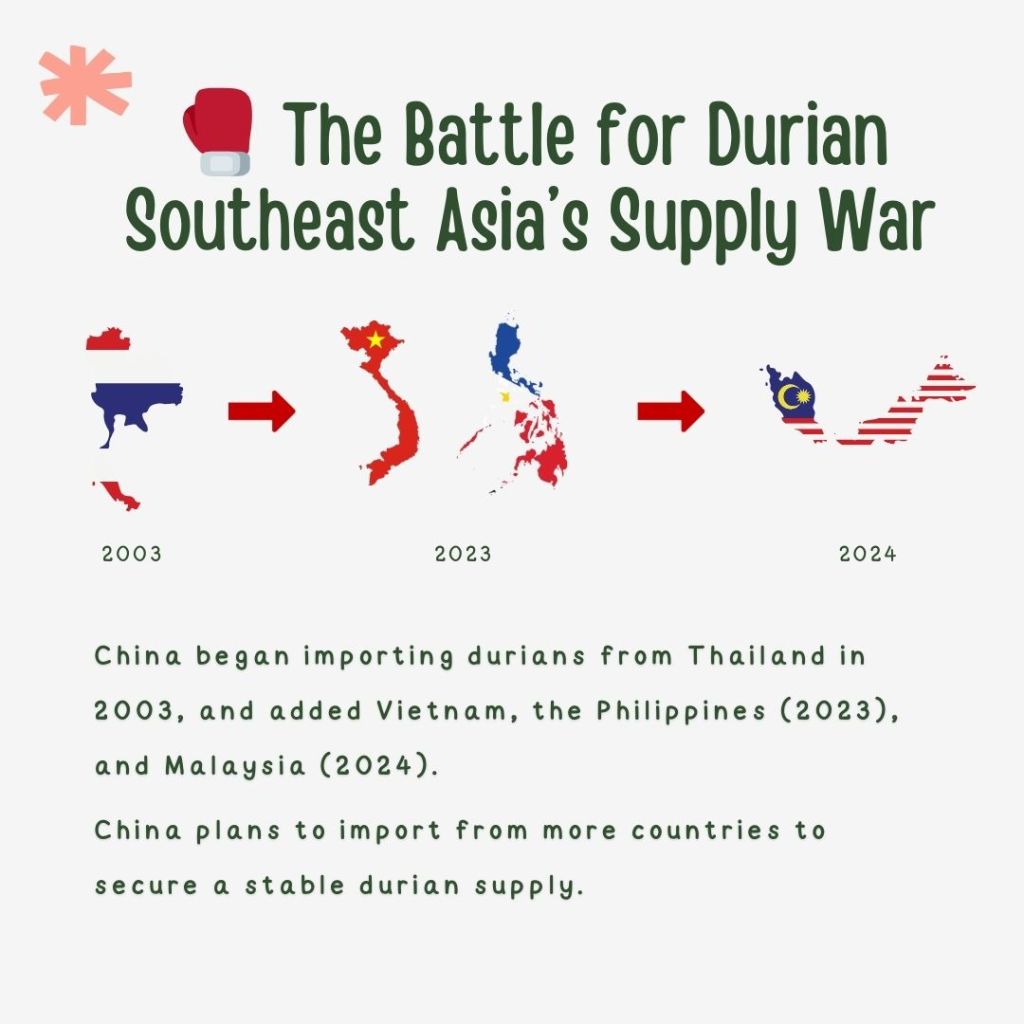

Thailand had dominated the Chinese durian market since 2003. However, since 2023, China began diversifying its supply.

- Vietnam and the Philippines were granted durian export approval in 2023.

- Malaysia started exporting durians to China in 2024.

- Indonesia is completing its legal procedures to enter the Chinese market, positioning itself as a new regional alternative.

The competition among ASEAN producers is intensifying as more countries seek access to China’s massive market.

4. Key Risks to the Durian Industry: Pests and Diseases

Major Pests:

- Fruit Borer (Conogethes punctiferalis): Larvae bore into the fruit, feeding on the pulp, causing premature drop and total market rejection.

- Mealybugs, Thrips, Mites: These sap-sucking insects weaken foliage and new shoots and may transmit viral diseases.

Major Diseases:

- Powdery Mildew: Appears as white fungal patches on leaves and buds, reducing photosynthesis and plant health.

5. Cultivation & Post-Harvest Challenges

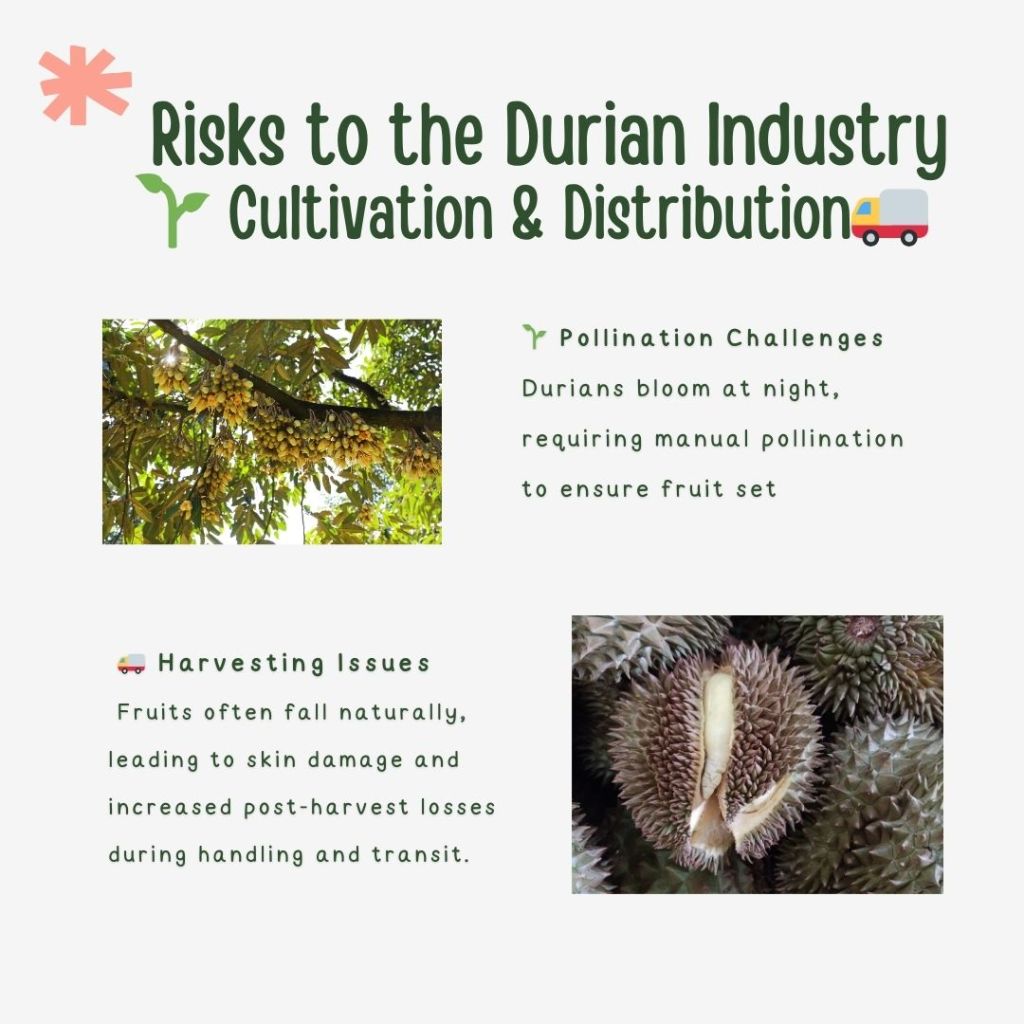

Pollination Issues:

- Durians bloom at night, limiting natural pollination by day insects.

- Self-pollination is rare, requiring manual pollination for good fruit set.

Harvest & Transport Problems:

- Durians are heavy and covered in sharp spines, making them prone to physical damage during harvest and shipping.

- Mature fruits drop naturally, leading to external shell damage and increased post-harvest losses.

6. Regulatory Risks: China’s Import Bans

In a 2024 incident, China suspended durian imports from 33 Vietnamese sources (18 farms and 15 distributors) due to excessive levels of heavy metals detected in the fruit.

This underscores the unpredictable and stringent nature of China’s import inspections, posing significant risk to exporters.

7. Future Outlook & Strategic Responses

A. Rising Demand & Competitive Supply

- Strategy: Develop high-quality cultivars and strong market branding to stand out.

B. Climate-driven Pest & Disease Pressure

- Strategy: Invest in sustainable biopesticide solutions and integrated pest management (IPM).

C. Regulatory Barriers in China

- Strategy: Strengthen traceability, quality control, and adopt sustainable farming practices to meet export standards.

Conclusion: As durian transforms into a global supercrop, Southeast Asian countries are racing to claim market share, especially in China. But with surging demand comes the need for sustainable practices, pest management, and smart export strategies to stay competitive in a volatile global trade environment.

Leave a comment